Why Do Housing Prices Seem So Crazy?

Economic Insights with our Head of Research and Analysis, Darob Malek-Madani:

Home prices spiked during the pandemic as Americans rushed to find larger spaces to live and work, especially outside of cities. From 2019 through 2021, the average American home price rose 33%.1 Since then, the average mortgage rate has more than doubled from 3.1% to 7%, and prices continued to rise another 13.6%.2 Taken all together, the typical mortgage payment on the average house more than doubled in four years, while median income rose just 22%.3 This means that to the average buyer, homes look four times as expensive as before the pandemic, yet people continue to pay for them. These facts are confounding to the average observer who, all things being equal, would be forgiven for expecting the prices of homes to drop after the pandemic shock ended or after interest rates doubled.

So what is going on here? There are several factors that may be contributing to the continued rise in housing prices:

- There has been no recession since the start of the pandemic and the rise in interest rates. Housing prices typically rise outside of recessions—but a rise in interest rates typically triggers recessions, so it is difficult to predict what should occur in a period of rising rates but no recession.

- There are very few people selling their homes. In 2023 and 2024, while the number of new homes for sale has been near pre-pandemic averages, there have been only about 50% fewer existing homes for sale than in 2018 and 2019.4 The obvious reason for this is that homeowners with mortgages likely have payments that are less than half of what they would be on an equivalent home they would move into and, therefore, have little incentive to move.

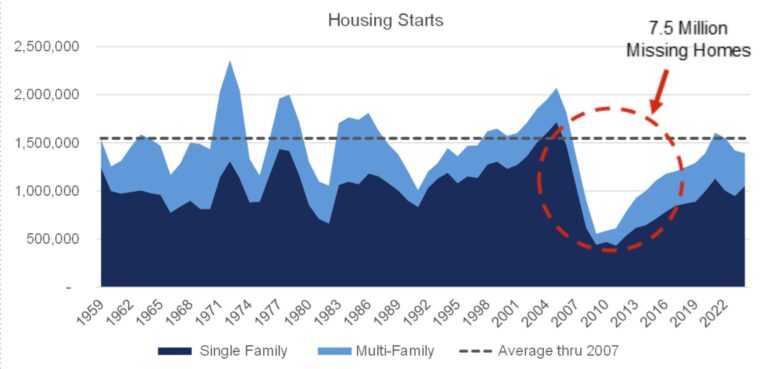

- New Homes have been in short supply since the financial crisis. From 1959 through 2007, an average of more than 1.5 million homes were built each year. Then, from 2008 through 2023, 1.1 million homes were built per year—that means that 7.5 million fewer homes were built than if the historic average had continued. Since 1959, the U.S. population has grown by more than 150 million and continues to increase by about two to three million people per year.5 Notably, the 330 million people who live in the U.S. now are also generally expected to live with fewer roommates and family members than in 1959.

So, what does this mean for the housing market going forward? First, it seems like the laws of supply and demand have not been warped–like in the housing bubble leading to the Great Recession. After all, housing prices spiked due to massive new demand during the pandemic, and then they continued rising through a strong economy with high inflation and low supply. Therefore, assuming a true soft landing is achieved, there is no recession, and interest rates begin to fall this year and into next, don’t be surprised if there is another spike in home prices as potential buyers find they can afford the new lower payments.

On the other hand, if a soft landing isn’t achieved, rates stay relatively high, and a recession eventually materializes, housing prices will likely fall. Ironically, though, if high interest rates last much longer, there could be even less supply in the future as builders keep projects on hold, waiting for rates that make construction more affordable or higher prices that can justify more expensive construction debt. Given that housing costs make up about one-third of the consumer price index, additional disruption in the supply of housing could lead again to high inflation when demand returns in the next cycle.