Economic Insights: The Fed at a Crossroads

Written By National’s Head of Research and Analysis, Darob Malek-Madani

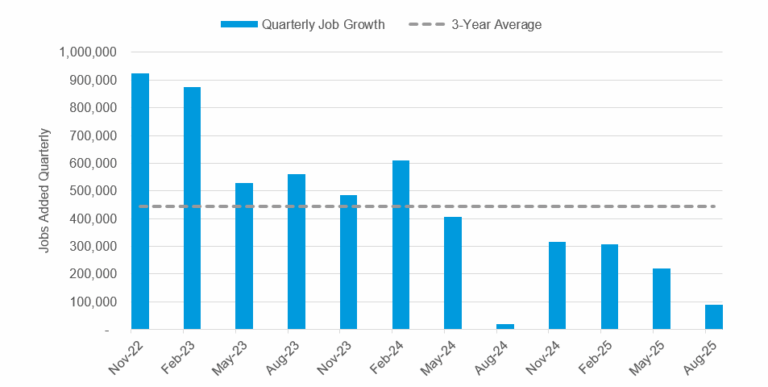

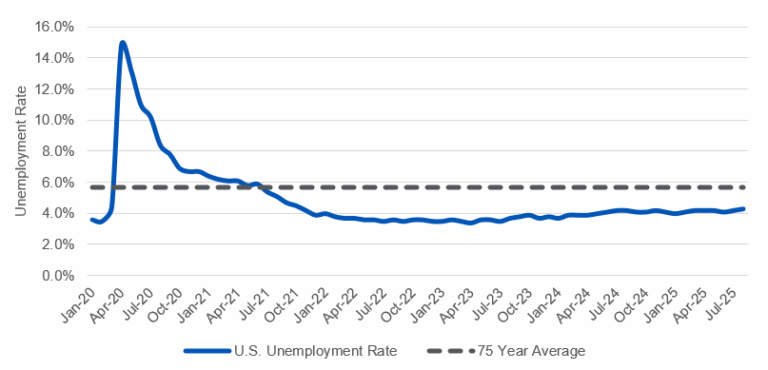

Over the past year the job market appeared strong while inflation hovered above the Fed’s target. This dynamic made it relatively easy for the Fed to continue to keep rates high and wait for inflation to come down. Now, however, there are signs the labor market is softening while inflation continues to run higher than target. The economy therefore may be at a turning point, and the Fed must decide whether to lower interest rates to boost employment or keep them elevated to combat inflation. The Fed’s decision hinges on whether the labor market will remain strong or begin to soften. In a world with rising tariffs, changing immigration patterns, and the introduction of AI, this task is easier said than done. The following illustrates the Fed’s dilemma.

The Case for Weakness in the Labor Market:

Falling Total Job Additions:

Diverging Employment Sectors:

U.S. Bureau of Labor Statistics. (2025, September 9). Current Employment Statistics Preliminary Benchmark (National) – March 2025. https://www.bls.gov/news.release/prebmk.nr0.htm

After many sectors returned to pre-pandemic trends in 2021 and 2022, there has been a divergence forming in the labor market. Sectors such as health and education have continued to grow steadily, while construction has surged with AI-related infrastructure development. Meanwhile, traditional powerhouses of the economy, like business and financial services and retail trade, have stagnated or even shed jobs in 2024 and 2025. This divergence suggested there could be underlying weaknesses, especially given that, over the past two and a half years, over 90 percent of all the net new private sector jobs were created in the traditionally non-cyclical or recession-resistant sectors of health and education.

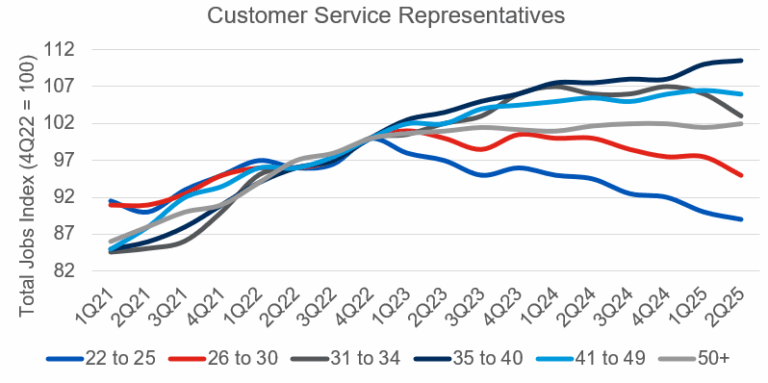

AI Impact:

Brynjolfsson, E., Chandar, B., & Chen, R. (2025, August 28). Canaries in the Coal Mine? Six Facts about the Recent Employment Effects of Artificial Intelligence. Stanford Digital Economy Lab. https://digitaleconomy.stanford.edu/publications/canaries-in-the-coal-mine/

AI’s influence feels pervasive, but its labor market effects have been difficult to quantify. A new study, shown in the chart above, however, has begun to identify a softening in the labor market for younger workers in fields most exposed to AI. They find that the number of workers under 30 in both software engineering and customer service has been falling since early 2023, when the capabilities of new AI models were first becoming widely known. This suggests younger, less experienced workers in these sectors may be being impacted by this new technology, and if they are merely the first workers to be affected, the coming AI boom may signal a broader softening of the labor market as its impacts become widely felt.

The Case for Strength in the Labor Market:

Unemployment Rate:

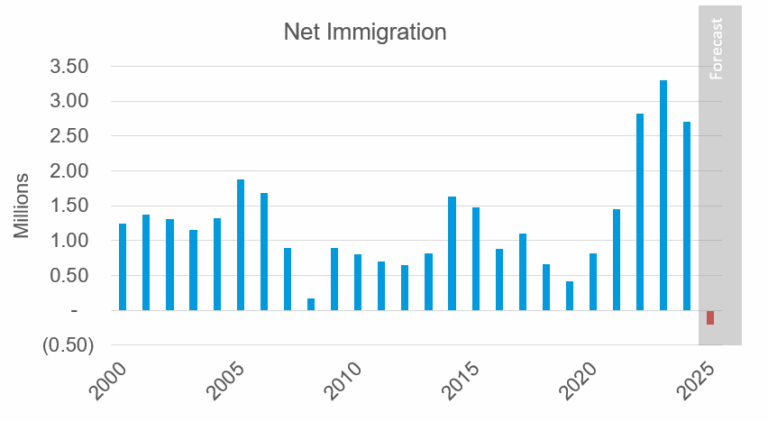

Population Growth Slowing:

Briggs, R., & Van Doren, P. (2025, July). Immigration policy and its macroeconomic effects in the second Trump administration (AEI Economic Policy Working Paper 2025-07). American Enterprise Institute. https://www.aei.org/wp-content/uploads/2025/07/Immigration-Policy-and-Its-Macroeconomic-Effects-in-the-Second-Trump-Administration.pdf?x85095

According to Congressional Budget Office estimates, net immigration has added more than 1 million people per year to the U.S. population, accounting for about 50% of the population growth of the U.S since 2000. The economy added roughly the same number of jobs per year, keeping labor supply and demand balanced. Immigration particularly surged over the past few years with more than 10 million people moving to the U.S. in the past four years. This surge coincided with a booming economy and helped to add hundreds of thousands of jobs each month, even in a period of record low unemployment. Shifting to 2025, it is difficult to predict what net immigration amounts to, especially when undocumented immigrants have more reason than ever to avoid being counted in official records, but most sources expect there to be a substantial reduction in immigration and many expect there to be net negative figures for the year. Given falling immigration numbers, it is not surprising to see the absolute number of jobs added each month decline or even become negative while the overall labor market remains tight.

Conclusion:

The Federal Reserve stands at a crossroads. It must decide in the next few months whether it will continue to hold rates steady until inflation is back to its target or continue lowering rates to get ahead of a potentially softening labor market. The delicacy of this decision is hard to overstate. Not only will its decision shape the economic landscape for the next several years but political pressure from the Whitehouse makes any deviation from its goals of full employment and low inflation risk making the Fed appear politically captured.