Economic Insights: A Tale of Three Real Estate Recessions

Written By National’s Head of Research and Analysis, Darob Malek-Madani

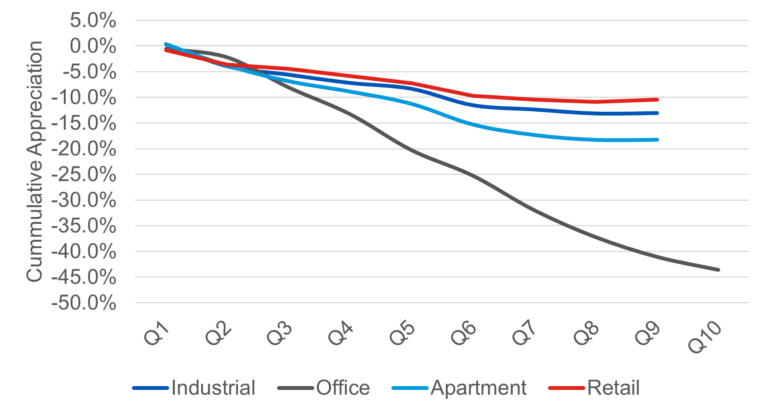

The current real estate downturn is beginning to show signs of hitting bottom. The initial decline in values began in late 2022 as long-term interest rates, closing in on four percent, pushed up cap rates across the sector, made debt more expensive and forced office owners to confront their real values in the post pandemic world. Since the start of the downturn, values have fallen a total of 21% in the NCREIF’s National Property Index (“NPI”). Office properties struggled the most, falling nearly 45% in value while retail, industrial and apartment properties have fallen between 10% and 20% depending on their sensitivity to rising interest rates. As of 9/30/24, after the Fed had begun lowering interest rates, apartment, retail and industrial properties appreciation turned positive again while office properties continued losing value—although at a slower rate than earlier in the cycle.

As the market begins to recover, it is worth examining previous real estate recessions to understand how returns behaved during past recovery periods. Though our analysis is limited to the only other two notable recessions in commercial real estate since the industry began sharing data through the National Council of Real Estate Fiduciaries (“NCREIF”) in 1978, the comparisons may still prove useful in setting expectations around the current downturn.

Comparing Previous Downturns

1990’s Recession:

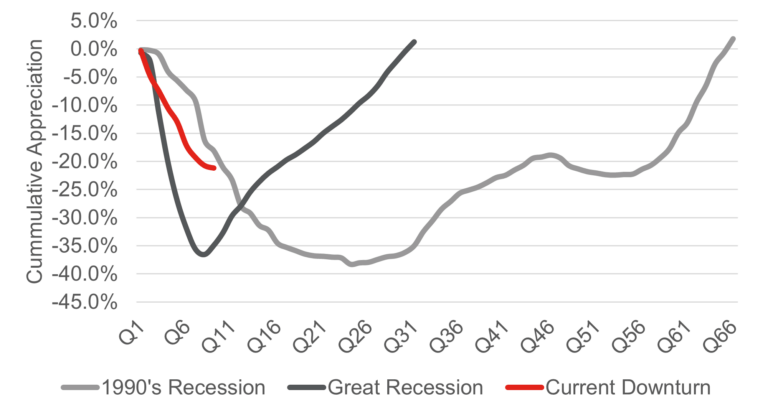

Although the broader recession of the early 90’s was not the most severe in recent history, it may be the worst commercial real estate downturn in living memory. Over the course of eight years, commercial real estate lost nearly 40% of its value. Then, it took another ten years—until 2006—for properties to recover to their 1990 values. During this period, cap rates were much higher than they are today, averaging eight percent, until 2002 when they began to steadily decline. Including the typical annual seven to eight percent income returns in the analysis, owners recovered their initial investment value by 1995.

The Great Recession:

The Great Recession was comparatively swift with values again dropping over 35%, but in less than two years. This recovery was also much faster and steadier than the 90’s recession with values returning to their pre-crisis peak in just four years. During the recovery, cap rates returned to their pre-recession downward trend and continued to boost appreciation returns through 2021.

What can we expect now?

Like the Great Recession, values have fallen for about two years and now appear poised to start rising. All product types aside from office have had at least one quarter of positive appreciation and the Fed has started lowering interest rates. Both previous commercial real estate recessions captured in the data ultimately benefitted from long-term interest rates and cap rate declines to boost their recovery. In the world today where long-term rates appear more likely to stay in the four percent range than fall, this recovery may not benefit from falling cap rates. The result could be a prolonged rise to pre-downturn values. Luckily it appears that investors will likely be digging themselves out of a much smaller hole than in previous cycles—as long as they are not heavily invested in office properties.

Today’s Downturn by Product Type