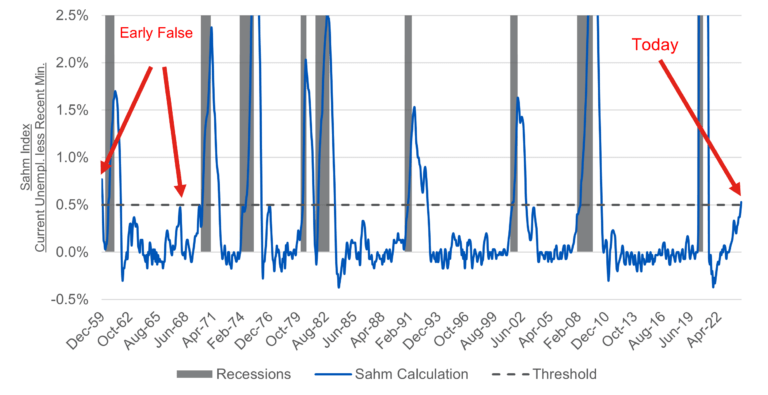

The Sahm Rule and the Recession

Over the weekend beginning August 2nd, global equities traders concluded that U.S. was likely in a recession. When Monday arrived, Japan’s stock market began to crash ending the day down more than 12% as stocks continued to fall around the world. The S&P 500 ended the day down 8.5% from its peak in mid-July.1,2 Market participants feared the Fed has made a significant mistake not lowering interest rates the previous week and some speculation had even begun that the Fed would call an emergency meeting to lower rates outside of its regular order.3 The main impetus for this fear was a steadily rising unemployment rate in the U.S. that triggered the so called Sahm rule on the previous Friday when unemployment reached 4.3%—up from 3.7% at the beginning of the year.4 Fast forward, two weeks, however, the S&P 500—and many other global indices—were back near record highs, an emergency rate cut from the fed was out of people’s minds, and the economic outlook is seemingly back to regular order. The underlying fundamentals, however, have not changed. The unemployment rate has, in fact, been rising significantly, inflation is falling, and a Fed rate cut, though not imminent, is expected this year. Given the recent turmoil, how should we feel about the fundamentals of the economy going forward?

What is the Sahm Rule and should we rely on it?

The Sahm rule states that a recession has begun when the three-month moving average of the national unemployment rate rises by 0.5 percentage points or more relative to its lowest point in the previous 12 months. The rule was designed based on historic data to allow policy makers to automatically inject fiscal stimulus, like extended unemployment benefits or stimulus checks, into the economy at the beginning of recession to head of the worst effects of a slowdown. Since 1970, the rule has correctly indicated the beginning of each recession and has only twice—before 1970—had false positives which were both quickly followed by recessions starting within the next year.

What is Happening Now?

Although unemployment has increased, it has increased despite the economy adding 2.5 million jobs over the past year.5 At the same time, real consumer spending, hourly wages, total income, and GDP are all at record highs making it nearly certain that we are not in a recession right now—an opinion shared by Claudia Sahm herself.6

So, is this Time Different?

There are a few factors that actually do make this time different from the previous eight recessions correctly marked by triggering the Sahm Rule:

- The tail of the COVID recession is still affecting the labor force. The pandemic and the response to it produced shocks the supply of labor as immigration shut down and then restarted, workers dropped out of the workforce to stay safe or retired early and have been relatively slow to return. All together, since the pandemic began four years ago, the U.S. labor force has grown by four million people.7 Given that there continue to be jobs added to the economy each month, the rise in the unemployment rate has primarily come from the addition of new entrants looking for work. Although the inability of all them to find a job quickly is still clearly a sign of relative weakness in the market, it could also presage an expansion rather than a recession as employers may have an opportunity to take advantage of a growing workforce.

- The rise of the gig economy, remote work and other non-traditional employment arrangements may be making tracking near real-time employment data more difficult. It may not be surprising to see traditional unemployment rising even as the economy remains relatively strong if many people find it relatively easy to supplement or replace lost wages with delivering food or working online where they may be missed by typical labor market surveys.

- Lastly maybe this time is not so different, but the Sahm rule has simply been activated a bit earlier in the cycle than usual. Although there is certainly little political appetite for acting quickly to send stimulus checks or unemployment benefits that the Sahm rule was designed to initiate, the Fed can still act decisively in September and will as usual share its projection of interest rates over the next couple of years—potentially giving economic actors the confidence to continue spending and investing even in a relatively soft market and avoid a recession all together.